Mr Dutton called on "well-intentioned" activists to stop encouraging the asylum seekers and refugees to remain in the detention centre.

Nov23

Ill-intentioned minister praises well-intentioned activists, "but..."

May11

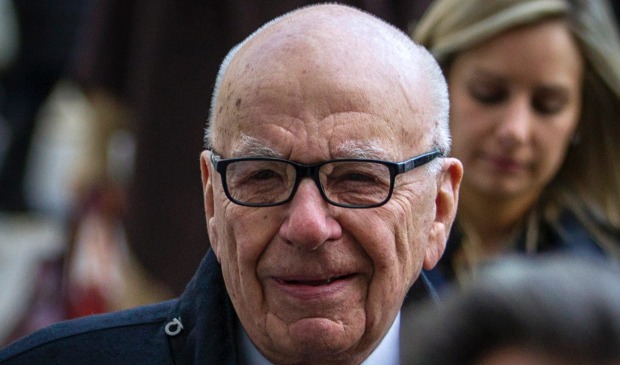

Rupert Murdoch's News Corp is highest risk for tax avoidance, says ATO

On April 22, ATO officials at the Senate committee inquiry declined to answer questions by former Greens leader Christine Milne about the tax status of News Australia Holdings which holds most of News Corp's Australian subsidiaries. However, the Financial Review has confirmed with several sources that News Corp is the mystery company still in Q1.

Apr6

Rupert Murdoch's US empire siphons $4.5 billion from Australian business virtually tax-free

"As a result of doing nothing more than putting a new $2 company at the top of the Australian group they later returned that capital in cash and shares with little tax consequence." Had these recent distributions been classed as dividends, News could have contributed a further $1 billion in tax to the Australian public purse. Dividends incur withholding tax at a rate of 30 per cent.